Northeast Estate Planning Guide:

Income Tax and Estate Planning Mashup

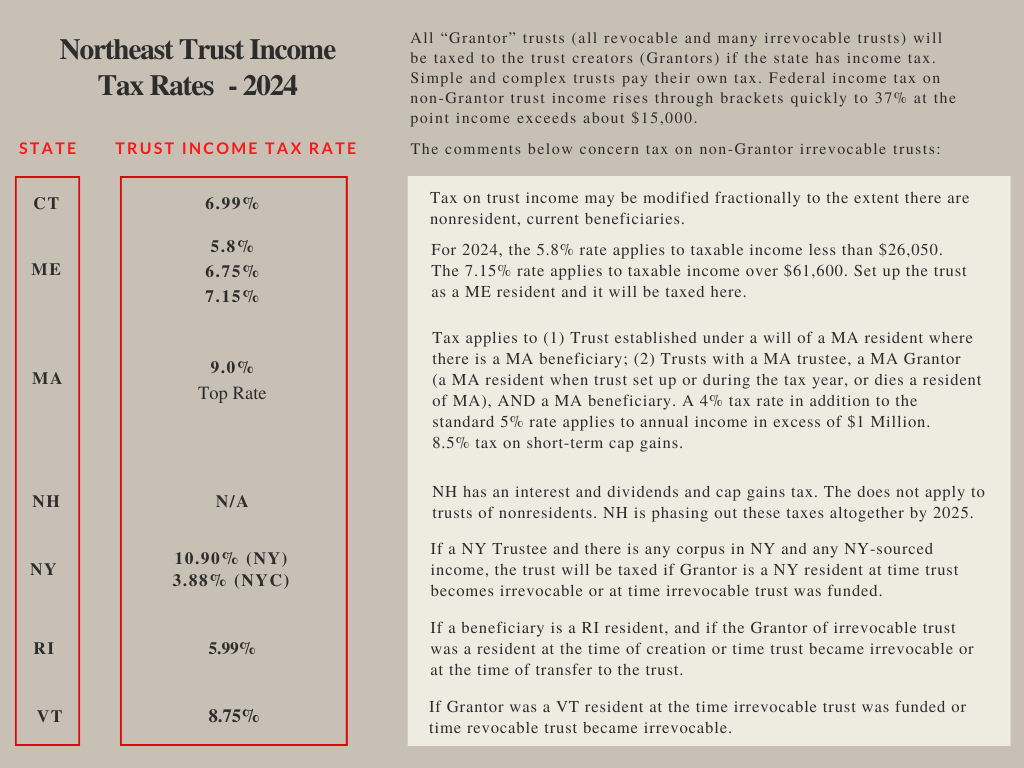

It remains popular to use irrevocable trusts not only for traditional estate tax savings, but increasingly, primarily for income tax savings. A U.S. Supreme Court case (Kaestner, 2019) highlighted the advantage of shopping for the right state to situs your irrevocable trust in.

Many states do not tax the income of trusts created by out-of-state grantors. At the same time the grantor’s home state may not tax the trust income if the trust is administered elsewhere. This represents a win-win tax-wise. The cost: The overhead of locating the trust in a favorable jurisdiction.

Don’t be fooled: the jurisdiction in which to house the trust does not have to be a tax haven for this to work. It may help to go to a no-income tax state such as New Hampshire, but that may not be necessary. Delaware, for example, does not tax out of state grantors and beneficiaries even though the state has an income tax. Meanwhile, other benefits can abound: The same irrevocable trust can protect assets from the Killer Ds, reduce or eliminate income tax, and reduce or eliminate estate and generation skipping taxes. Guess that’s a win-win, win-win. (Note: Revocable trusts need not apply.)

Click image to enlarge.

For more states or details, credit goes to American College of Trust and Estate Counsel (ACTEC).

Real-World Case Study

Tom and Amanda created an irrevocable, Grantor trust to hold title to investments, including securities producing dividends and interest, and capital gains and to remove the assets from their estate. They also transferred to the trust stock in a privately held company likely to increase in value. They are in the highest income tax bracket. They paid federal and state income tax on the interest, dividends and gains in the first year. At the start of the second year, Tom and Amanda moved the trust to an Independent Trustee located in Delaware. Delaware does not tax income of trusts sitused in the state created by non-resident trust Grantors. Tom and Amanda’s home state does not tax the income of a trust administered outside of the state. The trust continued to receive income from the securities in the trust and they sold the shares of the privately held company at a significant profit. They continued to pay federal income tax, but did not pay state income tax to either their home state or Delaware. Takeaway: Had Tom and Amanda chosen a state with no income tax, like NH, they could have achieved a similar result by moving there, or again by situsing the trust there.

Northeast Estate Planning Guide © Copyright 2020-2024 Timothy B. Borchers