Saving Taxes and Protecting the Estate with a SLAT

Saving Taxes and Protecting the Estate With a SLAT

The Spousal Lifetime Access Trust, or “SLAT” is an irrevocable trust technique used to reduce the size of an estate today by making an irrevocable gift to a spouse.

It works by taking an asset that is likely to appreciate significantly in value and removing it from taxation in either spouse’s estate. If more than the annual gift tax exclusion amount will be transferred to the trust, then a gift tax return must be filed and lifetime gift exemption will be utilized (up to federal gift tax limits). Especially useful in an estate subject to federal estate taxes, there is some application for this planning in smaller estates when there is exposure to a state estate tax. The SLAT freezes the value of the asset at today’s fair market value. Without the trust, all the growth in value of the asset – on top of its value today – would be taxed at death.

The cost basis of assets transferred to a SLAT is not “stepped up” at death, meaning capital gains tax might be owed upon a subsequent sale. If estate taxes are not a factor, the SLAT could instead be designed as an incomplete gift, which would allow tax basis step-up to save capital gains taxes later.

As a Grantor Trust, the income generated by SLAT assets during lifetime is taxed to the grantor (the spouse making the gift). This is often a benefit because of the differential between trust and personal income tax rates.

A SLAT may also be useful to protect assets from personal liabilities of either spouse since the spouse creating the trust no longer has any interest in, or control over the asset transferred. This Killer D protection extends to all beneficiaries of the trust, including those benefiting upon the grantor’s death.

Accessing SLAT assets is primarily achieved through the other spouse who is the lifetime beneficiary of the trust and who is often the trustee with access to the principal or income of the trust. However, smart drafting will also allow for the spouse making the gift to later be added as a beneficiary by a trust protector. Oftentimes, descendants are also named as beneficiaries during the lifetime of the spouse-beneficiary, thereby providing another option for (indirect) access or wealth transfer to the next generation.

Real-World Case Study

Matthew, a resident of Massachusetts, owns business interests in an LLC that holds real estate. He expects several of the properties to appreciate significantly in value in the coming years. Such growth would push the value of his estate over estate tax limits, resulting in a hefty tax at the time the LLC interests are passed down to his children.

Upon advice from his tax planning team, Matthew works with an estate attorney to draw up a Spousal Lifetime Access Trust and gifts his LLC ownership into the trust for the benefit of his wife, Stephanie. A gift tax return is filed with the IRS reporting the use of all of his $11.7M lifetime gift exemption, with no gift tax being due. As a result of the transfer, all of the future growth in value will pass estate tax-free to Matthew’s children upon the death of his wife.

Additionally, while Matthew no longer has a right to access the LLC property, his wife Stephanie does have access (the “A” in “SLAT”). As profits are paid out of the company each year to its owners, the SLAT receives its share, and Stephanie, as the trust beneficiary, can access those profits through the trust and use them towards joint obligations with her husband.

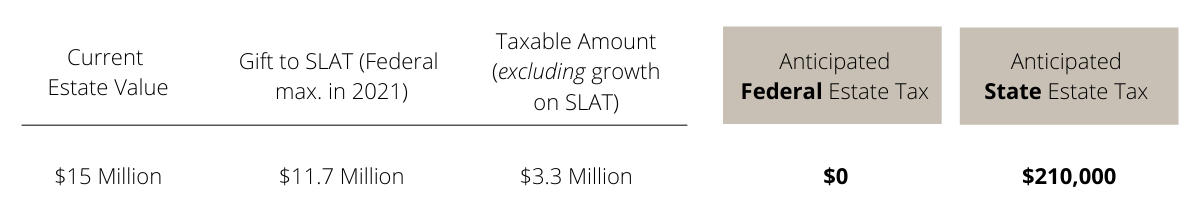

Before SLAT Planning

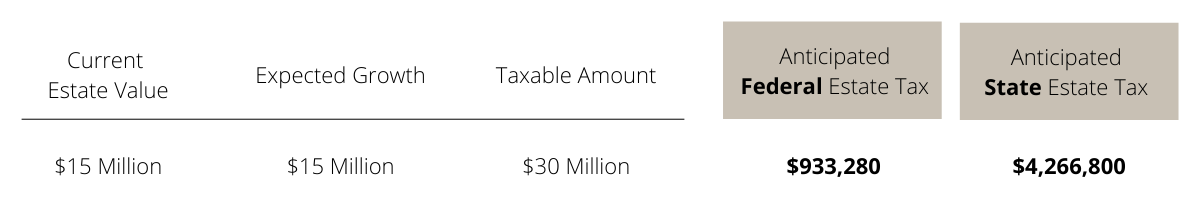

After SLAT Planning