Northeast Estate Planning Guide: Northeast Region Estate Taxes

2022 Northeast Estate Planning Guide:

Northeast Region Estate Taxes

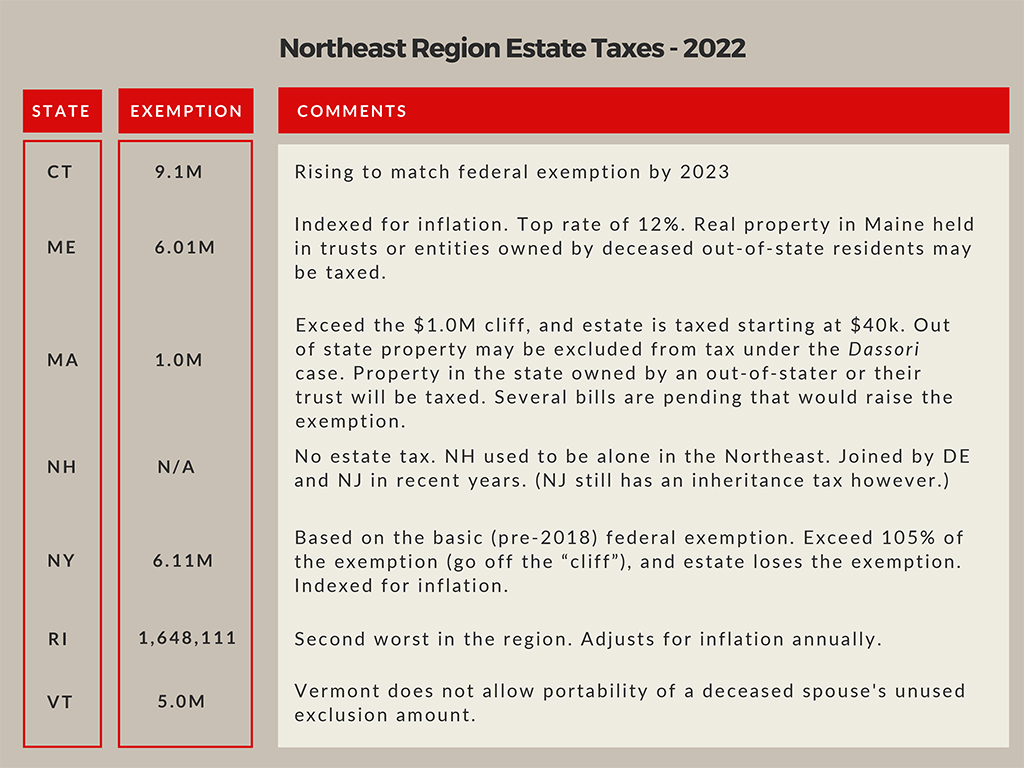

These charts for death and trust income taxes will provide a quick reference tool for planners in the northeast region of the country.

2022 federal annual gift tax exclusion: $16,000

2022 federal estate, lifetime gift, and GST (Generation Skipping Transfer) tax exclusion: $12.06m. Maximum of 40%. 100% charitable and marital deductions.

Regional Estate Tax Thresholds: The state estate tax thresholds range from $1m (MA) to $6.11m (NY), and $0 for NH. All allow 100% marital and charitable deductions. For more information see the chart below.

For more states or details, credit goes to the American College of Trust and Estate Counsel (ACTEC).

Real-World Estate Taxes Example | Case Study

Three people inherited $2m each at age 50. Allen lived in Rhode Island, Brenda in New York, and Charlie in New Hampshire. All invested wisely. They all died in 2022. By the time of their deaths, the inheritance grew to $5m each on top of the $3m they had on their own, for a total of $8m each (below the federal exemption amount).

The tax on Charlie’s estate would be $0 because NH has no estate tax. The tax on Brenda’s estate (RI) would be $702,710 because the taxable estate is $6,351,889 (8m – $1,648,111). The tax on Allen’s (NY) would be $773,200 because the taxable estate is 8 million. NY has a larger exemption, BUT it has a “cliff.” Go over the exemption, the “cliff” by more than 5%, and you start calculating the tax on the whole amount. RI has no cliff. Go figure.

Food for Thought: If each of them had inherited inside an Inheritance Trust, none of their estates would have paid estate tax on the $5m. For the explanation, see Generation Skipping Trusts.