Don’t Miss these 7 Frequently Overlooked Estate Planning Tasks

When you think of estate planning, you typically (and rightfully) think of setting up wills, trusts, and other necessary documents like power of attorney and a health care proxy. Getting these important documents in place, and funding your trusts, are the primary tasks of estate planning. But often overlooked are the secondary tasks, what we refer to as the “odds and ends.”

By the time you sign your estate planning documents, your head may be full, bursting with legal language and concepts. One of our primary focuses is to make sure you come away with a stellar education of your estate plan – and that you thoroughly understand it! But you still may be fatigued after considering what often are somber and emotionally charged decisions. This is why many estate plans end up with uncompleted tasks that seem insignificant at the time, but can cause undue stress and expense during the estate administration process.

Follow these 7 estate planning tips so you don’t miss these frequently overlooked tasks:

- Homeowners Insurance – If you have transferred your home into a trust, it is very important to make sure that your insurance company adds your trust and trustee(s) as additional insured for liability and personal property purposes. This is an important step to take care of during your lifetime.

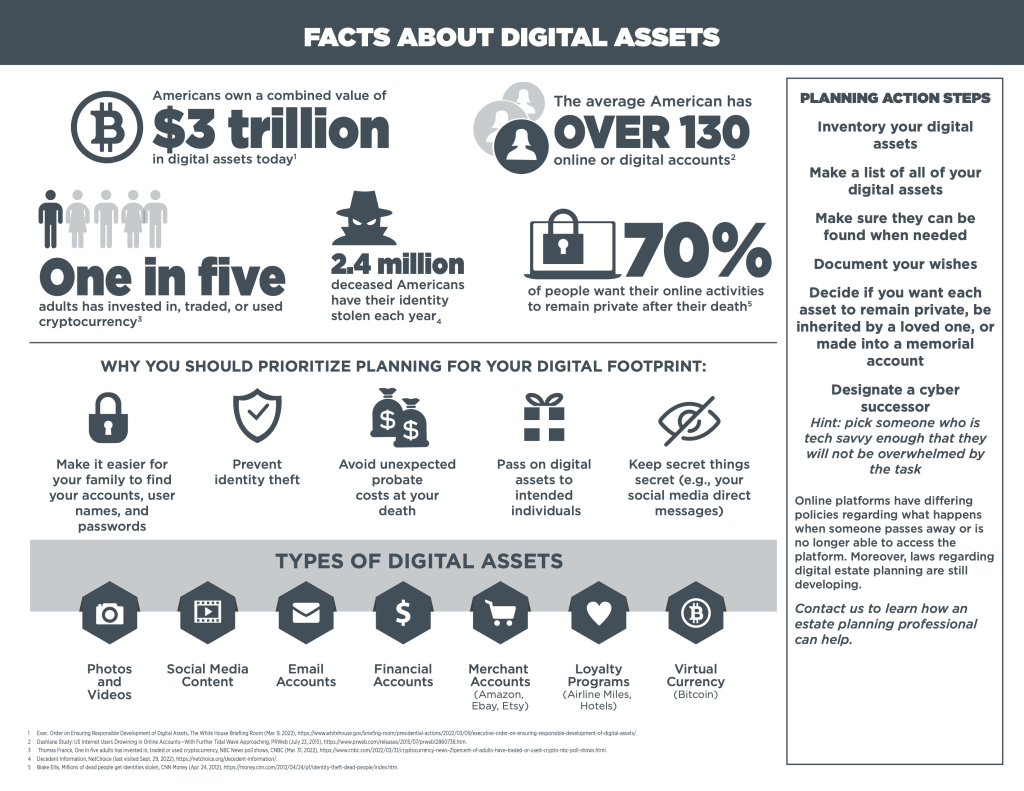

- Digital Accounts/Assets – Whether it is scrolling through Twitter, catching up with family on Facebook, perusing photos on Instagram, or spending a little too much time on TikTok, social media has found a place not only in our lives, but in our estate plans. Many social media platforms have the option to “memorialize” an account, essentially freezing it after death. You should track the sites where you have accounts, and the credentials needed to access them. Our Asset Trust Organizer™ has a specific sheet where you can track this information. Then, when the time comes, your family or a trusted person will be equipped to take the proper steps according to your wishes.

Remember: Tracking digital assets goes beyond social media accounts. Here’s a graphic that shares the many types of digital assets to include in your estate plan, and facts about their growing popularity:

- Business Interests – If you own your own business or otherwise have interest in one, your business should be incorporated into your estate plan. To do this, your attorney will prepare a “Business Assignment Agreement.” This transfers your interest and rights in a corporate entity to your trust.

- Personal Property – You will spend a lot of time during the estate planning process focusing on your bank accounts and other financial assets to ensure they are properly funded to your trust. What sometimes falls off the radar is personal property. Don’t forget to designate who should receive valuable and/or sentimental items of property. These include items like an engagement ring, a handmade blanket from Grandma, a specific piece of furniture, etc. We track your wishes with our “Personal Property Memorandum,” which your Trustee will use as a guide when the time comes to administer your estate.

- Memorial Wishes – Included in your estate plan binder is a Memorial Letter, where you can create special instructions for your family for your final arrangements. This includes directives about your funeral, burial, memorial, or something altogether unique. Many people choose to leave arrangements up to their loved ones. Others want a say in these details after they pass. This document is your opportunity to give as much or as little detail as you want, even including writing your own eulogy should you wish.

- Consolidating Bank Accounts – Consolidating bank accounts and other financial accounts makes your life a little easier, and lightens the load of your Personal Representative/Trustee as well. You can find in-depth recommendations in our article, A Personal Story: How Senior Paralegal Stephanie Helped Her Aging Parents Consolidate Their Financial Accounts With These 6 Questions.

- Safe Deposit Box – If you have a safe deposit box at a bank, place it in the name of your trust. Also, record the information regarding the box (e.g. bank location) in an easily accessible place. We typically recommend that you update your Asset Trust Organizer™ with this information, or otherwise keep relevant documentation with your estate plan binder.

A personal example of an inaccessible safe deposit box:

Attorney Deb Hedges is the Personal Representative for her father’s estate. When her father remarried, he had a prenup in place, which would affect how his estate should be paid out upon his death. He told Deb that the prenup was in a safe deposit box along with gold coins for her, her birth certificate, and his marriage certificate. The problem?

He never told Deb which bank held the safe deposit box.

So even though she is the court-appointed Personal Representative, no bank will tell her if his safe deposit box is at their bank. This has led to a very frustrating, and ultimately fruitless scavenger hunt. The ultimate impact is that his estate is being paid out as if no prenuptial agreement was in place. This could have been avoided if he had kept records of where the safe deposit box was, and how to access it.

How should you track the status of these estate planning odds and ends?

We use our innovative Asset Trust Organizer™ which tracks all of the assets that you would typically think about (such as bank accounts, investment accounts, retirement accounts, life insurance, real estate, etc.). We have also created several charts to specifically track the smaller items. For example, Chart 9 tracks Essential Access (safe deposit box, home safe, vehicle titles, etc.). Chart 11 tracks electronic accounts. This is a document that we continuously innovate and update to help organize your estate planning tasks.

For more information on what should be done during your lifetime, in order to ensure your plan functions properly afterwards, read our article, Before a Death | Legal Steps to Take.

Estate planning is an important process, but it can be a long and rigorous one. It never truly ends. Part of making sure your plan functions properly during your life and beyond is making sure it stays healthy. Are you worried that it isn’t? Do you have questions about any of the odds and ends that may have escaped your focus? If so, please set up a time to talk with a paralegal to discuss these important estate planning tasks.